Profit sharing is a complex and intriguing topic in the world of day trading. In a recent YouTube video titled “Analyzing Profit Sharing in Day Trading,” various aspects of this subject were discussed. The video delved into the technical details of day trading strategies, from setting up broadcast settings to utilizing ultra low latency streaming servers. It also touched on the importance of subscriber goals and the upcoming small account challenge. Join us as we explore the insights shared in this informative video and gain a better understanding of the dynamics of profit sharing in day trading.

Understanding Profit Sharing in Day Trading

Profit sharing models and structures play a crucial role in day trading. They determine how profits are distributed among traders and can greatly impact their overall success. In this session, we will delve into the intricacies of profit sharing models, the benefits, and potential risks involved. Our primary goal is to provide valuable insights and strategies for day traders looking to maximize their profits and build sustainable trading portfolios.

As part of our commitment to enhancing the trading experience for our chat room members, we have implemented low latency streaming servers. These servers ensure real-time communication and seamless interaction among members, enabling quick access to crucial trading information and market updates. With our focus on enhancing member engagement and providing a conducive environment for learning and collaboration, our low latency streaming servers offer a competitive advantage for our community.

Exploring Potential Stocks and Market Trends

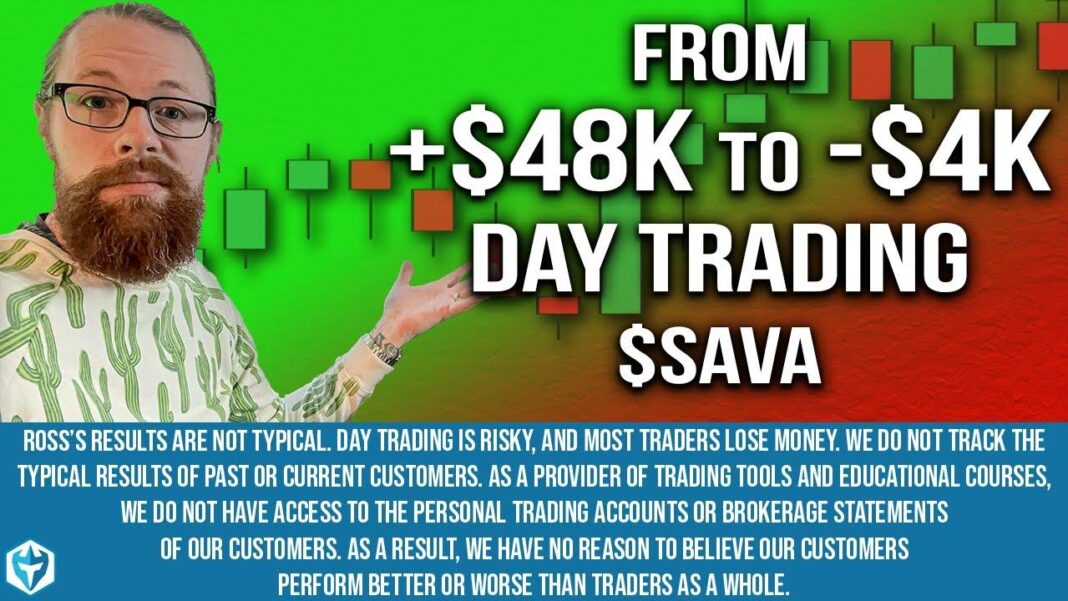

During the YouTube video, the presenter mentioned their goal of reaching one million subscribers by the end of the year and the potential for starting a small account challenge. They also discussed the challenges of trading lower priced stocks and analyzed a NASDAQ test stock during the broadcast. Additionally, there was mention of recent market news, such as jobless claims data for the S&P 500.

Stay tuned as we continue to explore potential stocks for a small account challenge, analyze market trends, and share valuable insights to help you navigate the dynamic world of day trading effectively.

Q&A

Q: What was discussed in the YouTube video titled “Analyzing Profit Sharing in Day Trading”?

A: The video began with a brief introduction and welcome message for viewers, followed by a discussion on the use of ultra low latency streaming servers for chat rooms. The presenter mentioned their goal of reaching one million subscribers by the end of the year and the potential for starting a small account challenge. Additionally, there was mention of the challenges of trading lower priced stocks and a NASDAQ test stock was analyzed during the broadcast. The video also touched on recent market news such as jobless claims data for the S&P 500.

Closing Remarks

In conclusion, the YouTube video provided valuable insights into profit sharing in day trading. It’s important to consider the various factors that can impact trading success, such as latency, server quality, and market news. Remember to stay informed, stay disciplined, and always be prepared before making any trading decisions. Thank you for tuning in and stay tuned for more informative content in the future. Remember to like, subscribe, and hit the notification bell to stay updated on all the latest content. Thank you for watching!

Title: Unlocking the Potential of Profit Sharing in Day Trading: A Comprehensive Analysis

Meta Title: How to Maximize Profit Sharing in Day Trading – A Comprehensive Guide

Meta Description: Are you looking to improve your day trading profits? Learn how implementing profit sharing strategies can unlock the full potential of your trades in this comprehensive guide.

Introduction:

In the world of day trading, every trader’s ultimate goal is to make a profit. However, not all trades result in a financial gain. In fact, many traders experience losses on a daily basis. This is where profit sharing comes into play. By implementing profit sharing strategies, traders can not only minimize losses but also maximize profits.

In this article, we will delve into the concept of profit sharing and its advantages in day trading. We will analyze various profit sharing models, their benefits, and provide practical tips on how traders can incorporate them into their trading strategies. So, let’s unlock the potential of profit sharing and take our day trading to the next level.

What is Profit Sharing?

Profit sharing in day trading refers to when a trader shares a portion of their gains with another party. This can be a mentor, a trading partner, or even a group of traders. It is a collaborative approach where everyone benefits from the shared profits.

There are two main forms of profit sharing in day trading – revenue sharing and performance-based sharing. In revenue sharing, traders split the profits based on a predetermined percentage. For example, two traders decide to split their profits 50-50, regardless of their individual performance. In performance-based sharing, the profits are divided based on each trader’s contribution to the profits. This could be in terms of research, analysis, trading strategies, or risk management.

Benefits of Profit Sharing in Day Trading:

1. Sharing Knowledge and Experience:

One of the greatest benefits of profit sharing in day trading is the opportunity to learn from experienced traders. By collaborating with a mentor or a trading partner, traders gain access to a wealth of knowledge and experience. They can learn new strategies, risk management methods, and even techniques for improving their overall trading performance. These insights can be invaluable for traders, especially those new to the market.

2. Minimizing Risk:

Day trading carries a significant amount of risk. In fact, the majority of traders lose money in the market. By implementing profit sharing strategies, traders can minimize their risk by sharing it with another party. This not only reduces their potential losses but also helps spread the risk over different trades.

3. Motivation and Accountability:

When traders share profits, it creates a sense of accountability and motivation. As each trader’s performance impacts the overall profits, it encourages individuals to put in their best effort. It also fosters a sense of teamwork and camaraderie, leading to a more positive and supportive trading environment.

4. Increased Capital:

Another advantage of profit sharing is that it allows traders to leverage their collective capital. By pooling their resources, traders can make larger trades with higher potential returns. This can help traders boost their profits and expand their trading opportunities.

Practical Tips for Implementing Profit Sharing:

1. Choose Your Partner(s) Wisely:

When it comes to profit sharing in day trading, it is crucial to collaborate with the right partner(s). Look for someone with a similar trading style, goals, and risk tolerance. It is also important to have good communication and trust between partners.

2. Set Clear Expectations and Boundaries:

Before entering into a profit sharing agreement, it is essential to define the terms and set clear expectations. This includes profit sharing percentages, trading strategies, risk management, and communication protocols. It is also advisable to have a written contract to avoid any future misunderstandings.

3. Be Transparent and Accountable:

Honesty and transparency are key components of a successful profit sharing partnership. Both parties should have access to trade records and regularly share updates on profits and losses. This promotes accountability and helps identify areas for improvement.

4. Review and Adapt:

It is essential to regularly review and adapt your profit-sharing strategy to ensure its effectiveness. Analyze your trades and make adjustments as needed to maximize profits and minimize risks.

Real-Life Example of Successful Profit Sharing:

One of the best examples of profit sharing in day trading is the story of hedge fund managers Bill Dunn and Marty Bergin. The two traders met while working for the same investment firm and decided to pool their resources and share profits. Together, they started a commodity trading advisor called Dunn Capital Management, which quickly became one of the most successful hedge funds in the world.

Their profit-sharing model was simple – a 20% performance-based fee. This meant that they would receive 20% of their clients’ profits, motivating them to generate high returns. The success of this model is evident from the fact that the firm’s flagship fund, the Dunn Capital WMA Program, has delivered an annualized return of over 17% since its inception in 1984 (as of December 2020).

Conclusion:

In conclusion, unlocking the potential of profit sharing in day trading can prove to be a game-changer for traders. The collaborative approach not only enhances knowledge and skills but also minimizes risks and boosts profits. By following practical tips and implementing a transparent and accountable profit-sharing model, traders can take their trading to new heights. So, team up with the right partner and start unlocking your trading potential today.

References:

1. https://www.investopedia.com/terms/p/profitsharing.asp

2. https://www.tradeciety.com/profit-sharing-day-trading/

3. https://www.barrons.com/articles/greatest-trade-ever-dunn-capital-51608656499

4. https://en.wikipedia.org/wiki/Marty_Bergin

5. https://en.wikipedia.org/wiki/Dunn_Capital_Management