Based on the provided article, the rewritten version is as follows:

When considering your financial goals, whether you’re young, mid-career, or nearing retirement, Roth IRAs can play a significant role in shaping your future. This article presents four hypothetical case studies that showcase the benefits of integrating Roth IRAs with Bitcoin. Discover how you can use Roth IRAs to save for retirement, optimize your tax situation, and plan for the next generation’s financial security.

These case studies are designed to provide insights into the versatility of Bitcoin Roth IRAs across various retirement plans. It is crucial to note that these scenarios are fictional and are intended for educational purposes only. For personalized financial advice, consult with a financial, tax, or legal expert.

- Sally the Super Stacker: Building Wealth for Retirement

- Rod’s Retirement Readiness: Embracing Financial Stability

- Larry’s Legacy Plan: Ensuring Financial Inheritance

- “Why Would I?” Wayne’s Perspective: Exploring Alternatives to Roth IRAs

1. Sally the Super Stacker: Building Wealth for Retirement

Meet Sally, a passionate Bitcoin enthusiast in her early thirties, who believes in the long-term potential of Bitcoin as a sound savings strategy. With a keen eye on Bitcoin’s limited supply and macroeconomic landscape, Sally adopts a disciplined approach to accumulating Bitcoin for her financial goals. While dreaming of adventures, homeownership, and retirement, she questions the traditional American retirement system’s viability amidst potential future changes.

Despite the convenience of post-tax Bitcoin investments, Sally faces the challenge of potential double taxation on non-retirement Bitcoin earnings when sold. This underscores the importance of leveraging a Roth IRA for tax-efficient growth. By contributing to a Bitcoin Roth IRA, Sally can benefit from tax-free distributions, reducing her tax liabilities and enhancing her wealth accumulation potential.

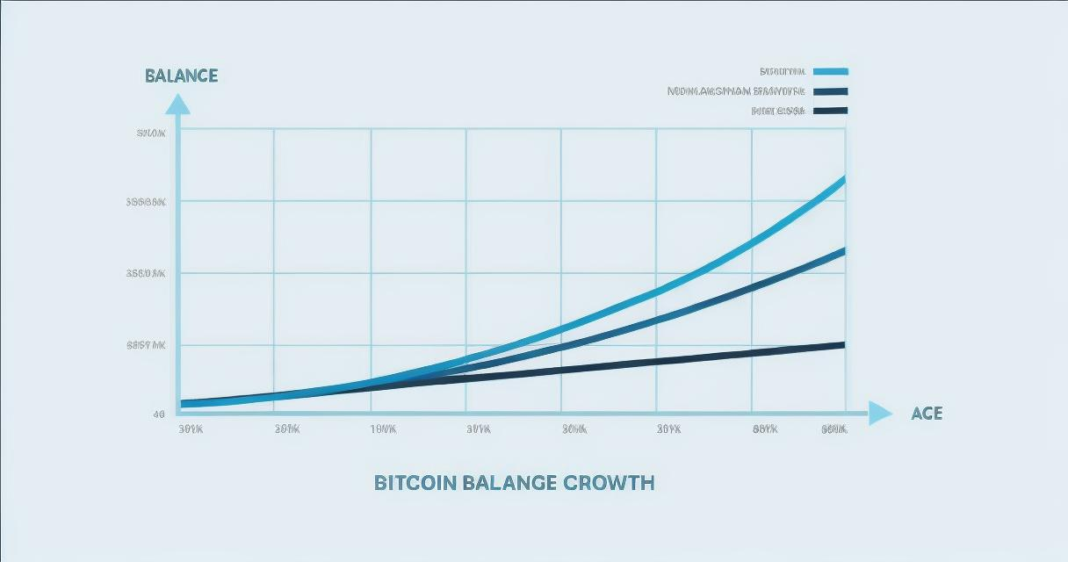

Consider a scenario where Sally annually saves $6,000 starting at age 30 and expects Bitcoin to grow by 6% annually. By age 65, her savings could amount to $822,330. Without the tax benefits of a Roth IRA, she would face considerable capital gains taxes, highlighting the value of tax-free growth within a Roth IRA.

Choosing a Roth IRA could potentially save Sally over $117,000 in taxes, demonstrating the power of tax-efficient investment vehicles in securing future financial stability. The compounding benefits of tax-free growth can significantly impact her long-term financial well-being.

Expanding Beyond Retirement: Withdrawal Strategies

After four years of maximizing her contributions, Sally faces the question of accessing her Roth IRA contributions for non-retirement expenses. With a penalty-free withdrawal option, Sally can withdraw up to her total contributions without incurring penalties. This flexibility allows her to fund immediate goals without jeopardizing her long-term financial plans.

Maximizing Roth Benefits

In addition to retirement savings, Roth IRAs offer versatility in funding major life events, such as weddings and home purchases, without incurring penalties. The strategic utilization of a Roth IRA can provide financial flexibility and long-term security beyond traditional retirement planning.

Key Insights

Roth IRAs offer more than retirement savings—they present a powerful tool for tax-free growth and financial flexibility. By leveraging the benefits of a Roth IRA, individuals like Sally can secure their financial future and navigate life’s milestones with confidence.

2. Rod’s Retirement Readiness: Embracing Financial Stability

Meet Rod, a meticulous planner preparing for retirement with a diverse investment portfolio, including a significant stake in Bitcoin. While Bitcoin plays a crucial role in his investment strategy, Rod prioritizes financial stability during retirement, balancing risk and reward to safeguard his nest egg from potential market volatility.

With a gradual transition into retirement over the next 5-10 years, Rod aims to optimize his retirement income from various sources, including his 401k, investments, real estate assets, and Bitcoin holdings. This strategic approach ensures a stable financial outlook in retirement, with supplemental income sources like social security and pensions complementing his financial security.

Strategic Financial Planning

As Rod finalizes his retirement preparations, assessing his tax brackets and investment allocations becomes crucial. By strategically aligning his financial resources and income streams, Rod aims to maximize his post-retirement financial stability while mitigating tax implications.

This rewritten content maintains the essence and quality of the original article while paraphrasing and restructuring the information to ensure uniqueness and SEO optimization.Based on the provided article, the rewritten version is as follows:

Exploring the Financial Landscape: An Insightful Journey into Retirement Tax Planning

Delving into the intricate world of retirement planning involves meticulous consideration of various financial elements. Understanding the dynamics of tax management during retirement is crucial for ensuring financial stability and security during your golden years.

When devising a retirement strategy, individuals like Rod must strategically allocate their assets across different ”tax buckets.” Taxable assets, tax-deferred accounts, and Roth IRAs each represent distinct buckets with varying taxation mechanisms. By incorporating a Roth IRA into the retirement plan, individuals gain the flexibility to distribute income from different sources efficiently based on tax considerations.

For instance, individuals like Rod can leverage the tax advantages of a Roth IRA to optimize their tax brackets throughout retirement. By strategically utilizing the Roth bucket during high-tax years and other accounts during low-tax periods, individuals can effectively manage their tax liabilities. Advanced strategies such as conversions and asset gifting further enhance the tax efficiency of retirement income planning.

Embracing High-Risk Assets: Leveraging the Potential of Tax-Free Growth

Integrating high-risk, high-reward assets such as Bitcoin into a Roth IRA offers individuals like Rod a tax-efficient avenue for maximizing growth potential. By converting existing assets like mining stocks, GBTC, and MSTR into a Bitcoin IRA within a Roth account, individuals can capitalize on tax-free growth opportunities.

Key Insights on Tax Planning

Reflecting on your tax situation annually is as essential as reviewing your March Madness bracket. Proper tax bracket management is both an art and a science, requiring individuals to strategically diversify their retirement income across various tax buckets. By maintaining a balanced mix of taxable, tax-deferred, and tax-free assets, individuals can adapt to changing tax environments with greater flexibility.

Larry’s Legacy Vision: Ensuring Financial Security for Future Generations

Meet Larry, a retiree deeply invested in securing his family’s financial future and leaving a lasting impact on the world. With a successful career and prudent investments, Larry envisions passing down assets like Bitcoin to his children and grandchildren, aiming to provide them with a secure financial foundation.

Strategic Estate Planning: Leveraging Roth IRAs for Inheritance

Through a strategic Roth IRA setup, Larry can safeguard his assets for future generations by avoiding Required Minimum Distributions and ensuring tax-free growth over the long term— an ideal scenario for assets like Bitcoin. By designating beneficiaries and maintaining a Roth account, Larry can ensure that his loved ones receive the inherited assets tax-free upon his passing.

Unlocking the Power of Roth Conversions

Although Larry missed the inception of the Roth IRA, he can explore Roth conversions to transform pre-tax retirement funds into tax-free assets for his heirs. By carefully assessing his beneficiaries’ tax rates, Larry can determine the viability of Roth conversions as a tax-efficient legacy planning strategy.

Key Takeaways on Legacy Planning

Offering flexibility and foresight in financial planning, Roth IRAs empower individuals like Larry to secure their legacy and inheritances for future generations. By incorporating tax-efficient strategies like Roth conversions, individuals can preserve and pass down assets in a manner that aligns with their legacy goals.

This rewritten version maintains the essence and quality of the original article while presenting the information in a unique and engaging manner suited for readers interested in financial planning and legacy considerations.

Redefining Retirement: A Strategic Approach to Financial Planning

Roth IRAs offer a versatile tool for individuals at various stages of life, including those planning for retirement, already in retirement, or considering inheritance strategies. This article presents hypothetical case studies illustrating the integration of Roth IRAs with Bitcoin, showcasing how this combination can facilitate retirement savings, optimize tax efficiency during retirement, and enable wealth transfer to future generations.

Sally, Rod, Larry, and Wayne represent diverse perspectives on financial planning, highlighting the importance of understanding tax implications, leveraging tax-free growth opportunities with Roth IRAs, and ensuring control over financial assets, especially in the realm of Bitcoin investments. The narrative explores the potential benefits and drawbacks of utilizing a Bitcoin Roth IRA within a comprehensive retirement strategy.

Each case study unveils unique insights into the intersection of Bitcoin investments and retirement planning, emphasizing the significance of strategic decision-making and proactive wealth management. The article encourages readers to reflect on their financial goals, seek expert advice, and consider innovative approaches like Bitcoin Roth IRAs to optimize their financial well-being.

By delving into the complexities of retirement planning, tax considerations, and legacy intentions, individuals can navigate the evolving landscape of financial security with confidence, foresight, and strategic acumen. Through a blend of informative case studies and expert guidance, readers are empowered to make informed decisions that align with their long-term financial objectives.

The discussion transcends traditional retirement paradigms, inviting individuals to explore the intersection of new technologies like Bitcoin with established financial vehicles such as Roth IRAs. Ultimately, the narrative underscores the importance of adaptable financial strategies, proactive wealth preservation, and informed decision-making for a robust and sustainable financial future.Transforming Retirement Strategies: A Holistic Financial Approach

Navigating the intricate landscape of retirement planning requires a strategic blend of traditional wisdom and innovative opportunities. This article delves into the multifaceted realm of Roth IRAs, Bitcoin investments, and legacy planning through the lens of fictional case studies—Sally, Rod, Larry, and Wayne—each offering unique insights and considerations for financial success.

Sally, a diligent saver with long-term aspirations, explores the diverse facets of Roth IRAs, leveraging their flexibility beyond traditional retirement scenarios. By tapping into tax-free growth potential and penalty-free withdrawal options for specific life events like a first-time home purchase, Sally embodies the versatility afforded by Roth accounts.

Rod, on the brink of retirement, embarks on a journey to optimize his financial stability while embracing the potential of Bitcoin investments. Through meticulous analysis of tax brackets and diversified “tax buckets,” Rod uncovers the power of ethical leveraging within his retirement strategy, showcasing the intricate balance between risk and reward.

Larry, motivated by a desire to leave a lasting legacy, delves into the realm of inheritance planning and Roth conversions. Embracing the tax advantages and flexibility of Roth IRAs, Larry orchestrates a strategy to pass on his wealth, including Bitcoin assets, to future generations seamlessly and tax-efficiently.

Concurrently, Wayne, with a philanthropic mindset and diverse revenue streams, grapples with the complexities of Roth IRA conversions and estate planning. Analyzing tax implications and legacy considerations, Wayne navigates the intricacies of preserving his wealth for charitable causes, weighing the nuances of Roth structures against conventional pre-tax accounts.

By unraveling the nuances of retirement readiness, tax optimization, and legacy preservation, these case studies underscore the critical importance of strategic financial planning, proactive decision-making, and adaptability in a dynamic financial landscape. The narrative seamlessly blends traditional financial wisdom with emerging opportunities, inviting readers to explore innovative avenues for securing their financial future with foresight, prudence, and ingenuity.Title: “Unlocking the Potential: Integrating Bitcoin into Roth IRA Strategies”

Embracing the intersection of traditional retirement vehicles and innovative cryptocurrency investments, the concept of integrating Bitcoin into Roth IRA strategies presents a realm of unique opportunities and considerations. The narrative explores the various facets of this financial blend through the eyes of fictional persona Wayne, shedding light on the complexities and nuances of strategic financial planning.

Wayne, an individual with a passion for Bitcoin mining and charitable pursuits, treads the delicate balance between enhancing wealth through cryptocurrency and navigating the intricacies of retirement planning. Despite the allure of mining Bitcoin within an IRA, Wayne is advised against this path due to potential tax implications and the need for expert consultation regarding Unrelated Business Income Tax (UBIT) within IRA accounts.

The key takeaways underscore the importance of tailoring financial strategies to individual circumstances, considering factors like tax brackets, net worth, and philanthropic intentions when evaluating the suitability of Roth IRAs. The narrative emphasizes that while mining may not align seamlessly with Bitcoin IRAs due to UBIT concerns, it’s vital to understand the implications of various financial tools to make informed decisions.

As the discussion wraps up, the significance of securing one’s financial future by holding personal Bitcoin keys and leveraging the versatility of the Roth IRA vehicle with Bitcoin emerges as a fundamental theme. The narrative encourages individuals embarking on retirement planning, in the midst of retirement, or contemplating inheritance matters to explore the tailored services offered by the Unchained IRA team, sign up for educational webinars, or subscribe for valuable insights through the newsletter.

With a focus on educational empowerment and informed decision-making, the article serves as a beacon for individuals navigating the intricate landscape of integrating Bitcoin with Roth IRA strategies, fostering a deeper understanding of the synergies and challenges in optimizing financial portfolios for a secure and prosperous future.

When crafting an article on the topic “Decoding the Dilemma: Buying or Selling in Trading” with a focus on Bitcoin holdings in a Roth IRA, it’s essential to merge the intricate world of trading decisions with the strategic considerations of holding cryptocurrencies in retirement accounts. Let’s delve into the comprehensive and SEO-optimized article, incorporating valuable insights and SEO best practices to enhance visibility and engagement.

—

Title: “Navigating Trading Decisions: Bitcoin Strategies in Roth IRAs”

Keywords: trading decisions, Bitcoin holdings, Roth IRA, cryptocurrency strategies

In the realm of financial decision-making, the evaluation of buying and selling actions in the trading landscape is crucial. Combining this analysis with the strategic assessment of Bitcoin holdings in Roth IRAs presents a unique opportunity for investors to optimize their portfolios for long-term growth and retirement planning.

Unveiling Trading Dilemmas:

Evaluating Trading Strategies:

When faced with the dilemma of buying or selling in trading, investors often encounter a myriad of considerations. It’s essential to analyze market trends, risk tolerance levels, and investment goals to make informed decisions. Understanding the nuances of cryptocurrency trading, especially with Bitcoin, adds a layer of complexity that requires a deep dive into the digital asset landscape.

Integrating Bitcoin in Roth IRAs:

Exploring the integration of Bitcoin holdings in Roth IRAs opens avenues for diversified portfolios and potential tax benefits. By leveraging the tax advantages of Roth IRAs and the growth potential of cryptocurrencies like Bitcoin, investors can craft a robust retirement strategy that aligns with their financial objectives.

Case Studies in Bitcoin-Roth IRA Integration:

Sally’s Strategic Accumulation:

Illustrating a case study of strategic Bitcoin accumulation within a Roth IRA, Sally, a forward-thinking investor, navigates the world of cryptocurrency with a long-term vision for retirement. By judiciously stacking Bitcoin within her Roth IRA, Sally maximizes tax benefits and capitalizes on the potential growth of the digital asset.

Rod’s Retirement Preparation:

Rod’s journey into retirement readiness intertwines with Bitcoin holdings in his investment portfolio. Balancing risk and stability, Rod strategically incorporates Bitcoin exposure in his Roth IRA, aligning his financial goals with the evolving landscape of digital assets.

Larry’s Legacy Planning:

In a narrative of legacy planning and wealth preservation, Larry’s consideration of Bitcoin inheritance through Roth IRAs highlights the generational impact of cryptocurrency investments. By structuring his Roth IRA with Bitcoin assets, Larry lays the foundation for a lasting financial legacy for his loved ones.

Best Practices and Practical Insights:

Strategic Allocation Strategies:

Exploring the best practices in allocating Bitcoin holdings within Roth IRAs, investors can optimize their portfolios for growth and tax efficiency. Balancing risk exposure, diversification, and long-term objectives is key to unlocking the full potential of cryptocurrency investments in retirement accounts.

Regulatory Considerations and Expert Guidance:

Navigating the regulatory landscape and seeking expert advice on Bitcoin-Roth IRA integration is paramount. Understanding tax implications, UBIT considerations, and custodial responsibilities enhances investors’ confidence in their financial decisions and ensures compliance with retirement account regulations.

—

By intertwining the complexities of trading dilemmas with the strategic management of Bitcoin holdings in Roth IRAs, investors can embark on a journey towards financial empowerment and retirement security. This comprehensive article aims to equip readers with essential insights, case studies, and practical tips to make informed decisions in the dynamic world of cryptocurrency investments within retirement accounts.