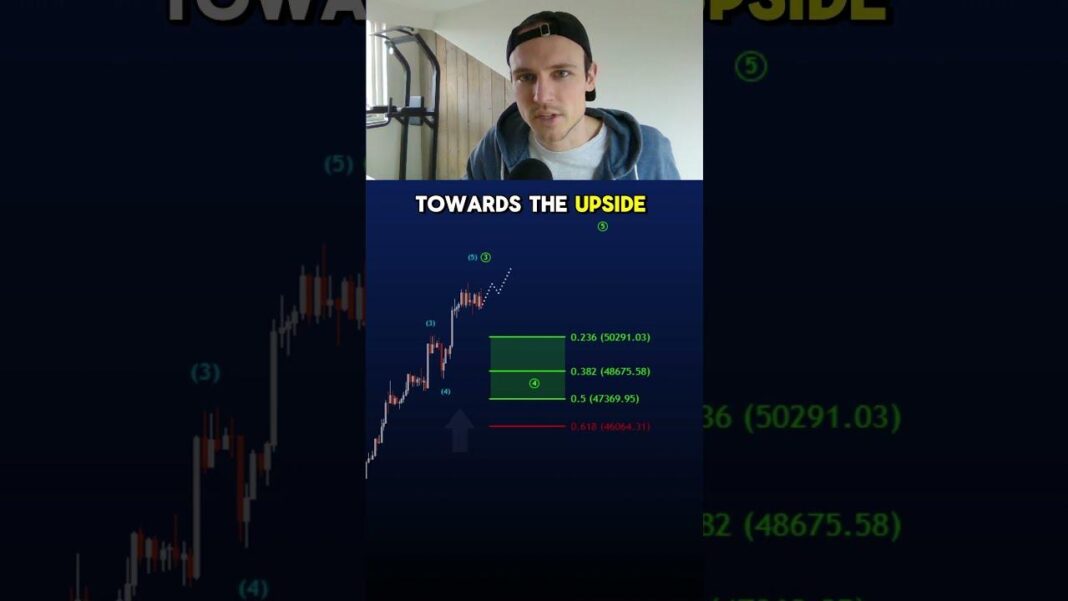

Welcome to our latest blog post where we delve into the intriguing world of Bitcoin Elliott Wave Analysis. In this post, we will discuss the insights shared in the YouTube video titled "Inside the Bitcoin Elliott Wave Analysis". The video presents a bullish scenario for Bitcoin on the 4-Hour chart, focusing on a five-wave impulsive structure to the upside. We will explore the expected wave movements, target areas, and potential corrective moves that traders and investors can anticipate in the coming days. Stay tuned as we break down the key points and implications of this analysis in the cryptocurrency market. On the 4-Hour chart, the bullish Bitcoin Elliot wave scenario indicates a five-wave impulsive structure to the upside. Currently, we are anticipating the end of wave three, followed by a larger sideways corrective structure in wave four. The common target area for this wave four ranges between the 236 and 0.5 levels, calculated from the low to the current high. If the price continues to rise, the target area for wave four will adjust upwards in tandem with price movement.

Following wave four, the next phase involves identifying a final impulsive structure in wave five towards the upside. Subsequently, we should prepare for a more extensive corrective move to the downside. It is crucial to monitor the progression of these wave structures to position trades effectively based on the Elliott Wave Analysis. Stay vigilant for potential upside targets and lookout for signals indicating a corrective move in the cryptocurrency market.

Q&A

Q: What is the bullish Bitcoin Elliott wave scenario discussed in the video?

A: The video discusses a five-wave impulsive structure to the upside on the 4-Hour chart, focusing on wave three and a bigger sideways corrective structure in wave four.

Q: Where is the common target area for wave four?

A: The common target area for wave four is between the 236 and the 0.5 Fibonacci retracement levels, taken from the low to the current high.

Q: What is expected after wave four according to the analysis?

A: After wave four, the analysis suggests another final impulsive structure to the upside in wave five, followed by a bigger corrective move to the downside.

Q: How does the target area for wave four change if prices move to higher levels?

A: If prices move to higher levels, the target area for wave four will also move with price towards the upside.

Q: What is the overall prediction for Bitcoin based on the Elliott wave analysis?

A: The analysis predicts a final impulsive structure to the upside in wave five, followed by a bigger corrective move to the downside.

Final Thoughts

In conclusion, the Bitcoin Elliott Wave Analysis on the 4-Hour chart suggests a bullish scenario with a five-wave impulsive structure to the upside. We are currently waiting for wave three to end and anticipate a larger corrective structure in wave four. The target area for wave four is between the 236 and 0.5 levels, but may adjust if price continues to move higher. Following wave four, we can expect another impulsive structure in wave five before a larger corrective move to the downside. Stay tuned for further updates on the Bitcoin market as it continues to evolve. Thank you for watching and happy trading!