Recent investment data from Wall Street suggests that Bitcoin is gaining increasing popularity as a preferred investment asset over traditional options like gold. This shift in investor sentiment is a significant development that reflects the evolving landscape of financial markets.

Traditionally, gold has been seen as a safe haven asset, a store of value during times of economic uncertainty or market volatility. However, in recent years, Bitcoin has emerged as a new contender for this role. The cryptocurrency’s decentralized nature and limited supply have attracted investors looking for alternative assets with potential for high returns.

One key factor driving this trend is the growing acceptance and adoption of Bitcoin among institutional investors. Large investment firms and hedge funds are starting to allocate a portion of their portfolios to cryptocurrencies, including Bitcoin. This institutional interest has helped legitimize Bitcoin as a viable investment option for a broader range of investors.

Additionally, the increasing mainstream acceptance of Bitcoin as a payment method and store of value has boosted its appeal among retail investors. More businesses are now accepting Bitcoin as a form of payment, and individuals are more comfortable holding and transacting in cryptocurrency.

As a result of these developments, some analysts predict that Bitcoin could eventually surpass gold as a preferred investment asset. While gold has a long history as a store of value, Bitcoin offers unique advantages, such as lower transaction costs and faster transfer times. This has led some investors to view Bitcoin as a more practical and efficient alternative to traditional assets like gold.

Overall, the data suggests that Wall Street is starting to view Bitcoin as a legitimate and valuable investment option. As more investors allocate funds to cryptocurrencies like Bitcoin, the financial landscape is likely to continue evolving, with digital assets playing an increasingly prominent role in investment portfolios.

Recent investment data from Grayscale Investments suggests that Wall Street may be replacing gold with Bitcoin as a preferred investment option. Grayscale, a major cryptocurrency asset management firm, reported a significant increase in Bitcoin investments while gold investments declined. This trend indicates a shift in investor preferences towards digital assets like Bitcoin, which are gaining popularity for their potential for high returns and diversification benefits.

The data also revealed that institutions, including hedge funds, family offices, and other large investors, are increasingly diversifying their portfolios with Bitcoin. This shift may be due to the growing acceptance and adoption of cryptocurrencies, as well as the potential for Bitcoin to serve as a store of value and hedge against inflation.

While gold has traditionally been viewed as a safe haven asset, investors are turning to Bitcoin for its perceived growth potential and ability to hedge against economic uncertainties. As more investors allocate funds to Bitcoin, it is becoming increasingly apparent that the cryptocurrency is gaining traction as a viable alternative to traditional investments like gold on Wall Street.

In recent years, the world of investing has seen a dramatic shift in the way investors perceive traditional assets like gold and how they are turning to alternative options such as Bitcoin. Investment data suggests that Wall Street is increasingly replacing gold with Bitcoin as a preferred store of value and hedge against inflation.

Gold has long been considered a safe haven asset by investors, with its ability to retain value during times of economic uncertainty and serve as a hedge against inflation. However, in recent years, Bitcoin has emerged as a new contender for this title. The digital currency, created in 2009, offers many of the same qualities as gold, such as limited supply and decentralized nature, but with the added benefits of being portable, easily divisible, and immune to government interference.

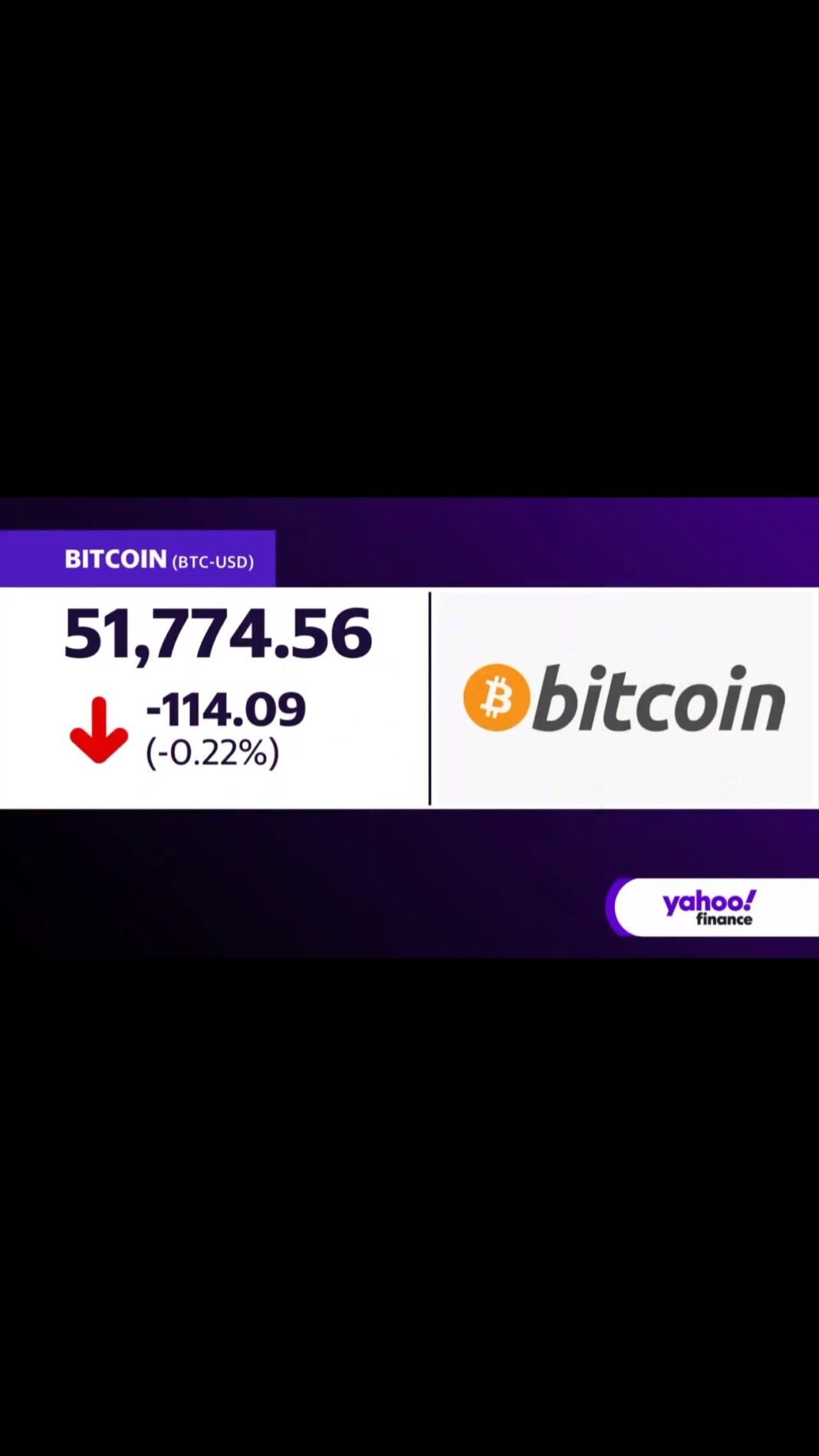

The shift towards Bitcoin can be seen in the investment data of institutional investors and hedge funds. According to a report by JPMorgan Chase, the market capitalization of Bitcoin has surpassed that of gold, signaling a growing interest in the digital currency as a store of value. Additionally, data from Grayscale Investments, a digital currency asset manager, shows that institutional investors are increasingly allocating capital to Bitcoin, with inflows into its Bitcoin Trust reaching record highs.

One of the key drivers behind this shift towards Bitcoin is the changing macroeconomic environment. With central banks around the world engaging in unprecedented monetary stimulus measures and governments racking up massive levels of debt, investors are increasingly turning to Bitcoin as a hedge against potential inflation and currency devaluation. Bitcoin’s fixed supply of 21 million coins, combined with its decentralized nature, makes it an attractive alternative to traditional fiat currencies.

Another factor driving Wall Street’s interest in Bitcoin is the growing acceptance of digital assets by mainstream financial institutions. Major banks like JPMorgan Chase and Goldman Sachs have started offering Bitcoin products to their clients, signaling a greater acceptance of the digital currency within the traditional financial system.

While the shift towards Bitcoin does not necessarily mark the end of gold as a store of value, it does highlight the growing acceptance of alternative assets in the investment world. As investors seek ways to protect their wealth in an increasingly uncertain economic environment, assets like Bitcoin are likely to play an increasingly important role in the modern investment portfolio.

In conclusion, investment data suggests that Wall Street is indeed replacing gold with Bitcoin as a preferred store of value and hedge against inflation. With its limited supply, decentralized nature, and growing acceptance among institutional investors, Bitcoin is emerging as a viable alternative to traditional safe haven assets like gold. As the world of investing continues to evolve, it will be interesting to see how this trend plays out and how investors adapt to the changing landscape of the financial markets.