The Significance of Reaching $100k in Net Worth

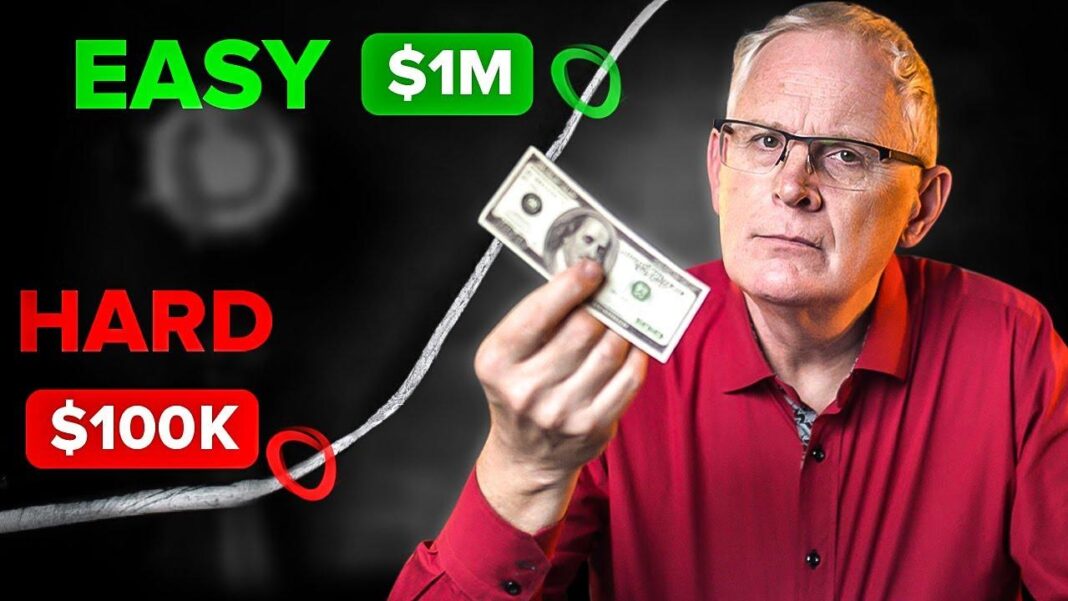

In the YouTube video titled "The Phenomenon of Net Worth Growth After Reaching $100k", the concept of reaching the first $100,000 in net worth is explored in depth. The video delves into the challenges of reaching this milestone, including the importance of earning power and compound interest in accumulating wealth. By focusing on building up this initial sum, the video suggests that one’s net worth will begin to grow exponentially. Join us as we discuss the insights and strategies shared in this thought-provoking video.

The Crucial Milestone of $100k in Net Worth

The phenomenon of net worth growth after reaching $100k is a crucial milestone in building wealth. This significant amount marks the beginning of exponential growth in your financial portfolio. By focusing on reaching this initial goal, you set yourself up for long-term success in accumulating wealth.

The Challenges of Reaching $100k

Two main challenges that younger generations face in achieving this milestone are earning power and lack of compound interest. With decreasing buying power compared to previous generations, it’s essential for younger individuals to leverage online opportunities for maximizing their income potential. Additionally, understanding the power of compound interest and starting early can significantly impact the growth of your investments over time. By actively contributing to your investment pot and resisting the temptation to spend impulsively, you pave the way for substantial wealth accumulation beyond the $100k mark.

Q&A

Q: What is the main advice given in the YouTube video “The Phenomenon of Net Worth Growth After Reaching $100k”?

A: The main advice is to focus on building the first $100,000 of net worth, as after reaching that milestone, your net worth will start to grow exponentially.

Q: Why is reaching the first $100,000 considered the hardest?

A: There are two main reasons for this. The first reason is your earning power, which may be lower when you are younger compared to older generations. The second reason is the lack of compound interest working in your favor until you have at least $100,000 invested.

Q: How can younger individuals take advantage of their earning potential in the digital age?

A: Younger individuals can take advantage of the opportunities presented by the internet to make money through online side hustles and investments, as older generations may not be as familiar with technology and online platforms.

Q: How does compound interest play a role in building wealth?

A: Compound interest is like a snowball effect, where your investment grows over time and earns interest on the interest earned. However, in order to fully benefit from compound interest, you need to have a significant amount of money invested, such as the first $100,000.

Q: What personal experience does the speaker share in the video?

A: The speaker shares their experience of working multiple side hustles simultaneously and resisting the urge to spend money on luxuries in order to reach their first $100,000 of net worth.

In Retrospect

In conclusion, reaching that first $100,000 in net worth can be the most challenging part of building wealth. As discussed in the YouTube video, the combination of limitations in earning power and lack of compound interest can make it seem like an uphill battle. However, by focusing on increasing your income and being disciplined with your spending, it is possible to reach that milestone and watch your net worth grow exponentially. Remember, the journey to financial success is a marathon, not a sprint. Stay focused, stay determined, and keep working towards your financial goals. With perseverance and patience, you can achieve the wealth and financial security you desire.

Unlocking the Secret to Skyrocketing Net Worth After Hitting $100k: Tips, Tricks, and Real-Life Examples

Hitting the milestone of a six-figure net worth is an achievement worth celebrating. This achievement may come as a result of hard work, smart investments, or a combination of both. However, it shouldn’t be the end goal for financial success. There’s always room for growth and improvement, even after reaching the $100k mark. Whether you’re already at this stage or still working towards it, it’s essential to understand how to unlock the secret to skyrocketing your net worth even further. In this article, we’ll discuss tips, tricks, and real-life examples of how you can achieve this goal.

What is Net Worth?

Before we dive into the secret to skyrocketing your net worth, let’s first understand what it means. Net worth is simply the difference between your assets and liabilities. To calculate it, you add up all your assets, such as your savings, investments, real estate, and subtract your liabilities, including loans, mortgages, and credit card debt. The amount that remains is your net worth.

Why is Net Worth Important?

Your net worth is a reflection of your financial health and stability. It’s a crucial number to keep an eye on as it can help you track your progress towards achieving your financial goals. A higher net worth can also give you a sense of security and enable you to make significant purchases or investments in the future.

Tips to Skyrocket Your Net Worth After Hitting $100k

1. Create a Budget and Stick to It

Creating and sticking to a budget is essential, regardless of your net worth. But it becomes more critical as your net worth increases. A budget can help you control your spending and ensure that your money is being used effectively. It can also help you identify areas in which you can cut back and redirect those funds towards investments or paying off debt, thereby increasing your net worth.

2. Invest in Yourself

Your education and skills are key assets, and investing in yourself can significantly increase your earning potential. Consider taking courses or obtaining certifications that can help you advance in your career or start a side business. Additionally, developing new skills can lead to better job opportunities or higher-paying roles.

3. Diversify Your Investments

One of the secrets to increasing your net worth is to have a diverse portfolio of investments. Putting all your eggs in one basket can be risky and limit your potential for growth. Consider investing in a mix of assets such as stocks, real estate, and even alternative investments like cryptocurrency. Diversifying your investments can help you mitigate risks and maximize returns.

4. Review Your Investments Regularly

Just like a budget, it’s essential to monitor and review your investments regularly. Keep track of how your investments are performing and make adjustments, if necessary. For example, if a particular stock isn’t performing well, consider selling it and reinvesting in something else. Staying on top of your investments can help you make informed decisions and ultimately increase your net worth.

5. Cut Expenses and Negotiate Better Deals

As your income increases, it’s easy to give in to lifestyle inflation and start spending more. However, keeping your expenses in check will allow you to save more and increase your net worth. Cut back on unnecessary expenses and try negotiating better deals on services you regularly use. For example, you can call your internet or phone service provider and ask for a better rate. Every dollar you save can make a significant impact in the long run.

6. Maximize Your Retirement Contributions

If you’re not maxing out your retirement contributions, consider doing so after hitting the $100k net worth milestone. This can help boost your retirement savings and reduce your taxable income. Depending on your employer’s retirement plan, you may also be eligible for a matching contribution, which is essentially free money. Take advantage of this opportunity to supercharge your retirement savings and increase your net worth.

Real-Life Examples

1. The Story of Holly Johnson

Holly Johnson and her husband Greg had a net worth of $200,000 when they hit their 30s. By following strict budgeting and saving strategies, diversifying their income streams, and investing in rental properties, their net worth skyrocketed to over $1 million within just five years. They continue to track their net worth and make smart financial decisions to increase it even further.

2. The Journey of Chris Reining

Chris Reining became a millionaire at the age of 35 after saving aggressively, investing in low-cost index funds, and living below his means. By tracking his net worth and continuously making informed decisions regarding his investments, Chris was able to retire early and live off his investments, which continue to grow his net worth.

Conclusion

Reaching a six-figure net worth is a significant achievement, but it’s crucial to keep pushing towards financial success. By creating a budget, investing in yourself, diversifying your investments, reviewing your expenses, maxing out your retirement contributions, and taking inspiration from real-life examples, you can unlock the secret to skyrocketing your net worth even further. Remember to constantly track your net worth and make informed decisions to continue growing and reaching your financial goals.